While many organisations have a lot on their plates right now, sooner or later they’ll need to think about whether to relocate or stay in their existing premises when their lease expires. Either way, they’ll need to address the commercial terms that sit around that decision.

Besides having to negotiate the market rent and the lease tenure, tenants are forced to consider how rent reviews will be structured throughout the lease term. Assuming the average lease is between 6 and 10 years, the landlord will be seeking the opportunity to review the rent on multiple occasions in the hope of achieving rent increases during the term and any renewals provided.

The decision for tenants is what are optimal intervals between rent reviews and what mechanism offers the best chance of preventing excessive rent hikes during a market surge and providing some downside benefit in a weak market.

The evolution of rent review mechanisms

Historically, rents reviews have been spaced out at two or three yearly intervals and realigned to the “current market rent”. Whilst older leases provided only for market reviews, a growing number of leases after the 2000’s started to contain fixed annual rent increases mirroring lease structures in Australia. Today, fixed increases and CPI adjustment mechanisms are much more common, either on their own or combined with a periodic market review.

So when considering rent reviews, is it best to secure fixed or CPI annual increases, stick with regular market reviews or have a combination of the two? Does it matter?

Before working through a scenario, remember that most market reviews have a ‘soft ratchet’. This means that, at the review, the rental can’t fall below the level set at an earlier review. In many cases, this ratchet is to the rent set at the commencement of the lease.

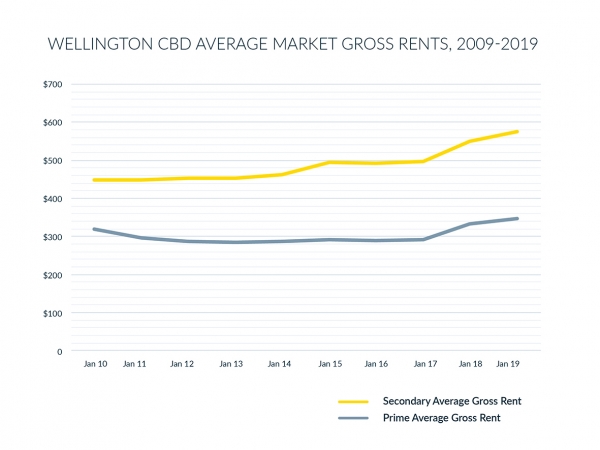

Wellington office market – 10-year comparison of market rents

Taking a 10-year period between December 2009 and December 2019, average gross rents for secondarybuildings in Wellington increased from $342psm to $348psm, i.e. 1.65%. This very low increase over the course of a decade was primarily due to a “flight to quality” and low demand for lower quality (secondary) space.

During the same period, prime gross rents increased from $465 to $575 – a 23.7 % increase. This was driven by new development rents, higher seismic ratings (compared to secondary buildings) and, significantly, scarcity of stock following the 2016 Kaikoura earthquake.

The rental rate movements are shown below.

Impact of fixed increases

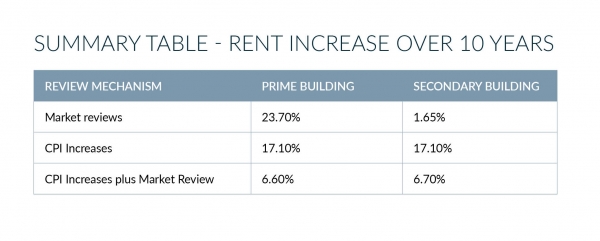

If during this same period tenants in both types of buildings had fixed their rent to annual CPI increases, the rent would have increased 17.1% over the 10 years.

As a result, the tenant located in a prime building would most likely have experienced a much slower rate of rental growth (17.1% with CPI increases vs 23.7% with market increases) than a tenant located a secondary building (17.1% vs 1.65%), all other things being equal.

Impact of a market review

Now, if there was a market review in say, January 2015 (five years after the lease commenced) with a soft ratchet set to the commencement rent, what is the impact?

The tenant in the prime space would have been even better off. Let’s examine.

Between December 2009 to December 2014, the CPI increased by 9.5%. However, market rents over this period actually declined slightly (-0.5%). Therefore, the inclusion of a market review in year five would have lowered the rent from $510psm to $465. If the rent had continued to be adjusted for CPI after year five, it would have then reached $496psm by lease expiry, a 6.6% increase over the commencement rent rather than $575 if CPI adjustments had been made for the whole term of the lease.

By comparison, a market review in year five for the secondary space would have reduced the rent from $375psm after five years of CPI increases to $342 (the lowest rate assuming the rent can’t drop below the starting rent of $342). Continuing with CPI increases until the end of year 10, the rental rate arrives at $365psm, also an increase of 6.7% over the starting rent. This table summarises the positions:

In summary, if you were in a secondary building, you would have been better off with market rents at each review rather than CPI increases (1.65% market increase vs 17.1% with CPI), or at least including a market review at some point during the lease term (1.65% market increase vs 7% CPI/market review). If you were in prime space, you would have benefited by having a combination of reviews to market and CPI increases (7% vs 23.7%).

Actual results will vary over different time periods, between buildings, locations and a range of other factors which determine rents. However, we can reasonably conclude that by having a market review at some point during the lease term, there is an opportunity to re-align the rent with the market and limit the impact of fixed or CPI increases which otherwise would automatically ratchet the rent up regardless of whether market rents have increased.

Out of sync or without limits – which is better?

Fixed or CPI increases have the advantage of reducing sudden upside risk, but over a longer period will move out of sync with market trends. On the other hand, having only market reviews may reflect the current environment, but should there be a tight market such as we have seen over the last 10 years for prime space in Wellington, rents can jump up significantly, potentially without any upper limit to the percentage increase.

We recommend clients include a market review in their leases if fixed or CPI increases are proposed. While landlords may require a soft ratchet, tenants should seek a cap on any increase to better manage risk. That way, costs over the term of the lease can be more accurately forecast and risk better managed.

Ultimately the rent review is one of five key commercial levers in play in a negotiation – lease term, rent, rent reviews, incentives and “nature” of the space you are leasing – what are you really getting?

If you are unsure about how your rent reviews are best structured for your circumstances or are looking at renegotiating your lease, contact us and we can help you develop a specific set of strategies and tactics to maximise your negotiation leverage. This is particularly acute in a post-COVID environment.